Ballistic Composites Market to Hit USD 4.6 Billion by 2035, Driven by Defense Upgrades & Lightweight Protection Demand

The United Kingdom ballistic composites market grows at 7.1% CAGR, driven by defense investments in protective gear, riot shields, and lightweight armor.

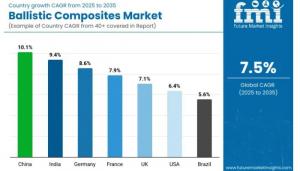

NEWARK, DE, UNITED STATES, August 11, 2025 /EINPresswire.com/ -- The global Ballistic Composites Market is on an unprecedented growth trajectory, projected to expand from USD 2.2 billion in 2025 to USD 4.6 billion by 2035, achieving a 7.5% CAGR. This surge is fueled by a worldwide focus on defense modernization, homeland security upgrades, and the growing need for lightweight materials that deliver superior ballistic protection without compromising mobility.

Manufacturers with the capabilities to meet stringent performance requirements while optimizing cost and production efficiency stand to capture significant value over the coming decade.

Why the Market is Growing – A Manufacturer’s Perspective

The demand for ballistic composites is being propelled by several converging trends:

• Military Modernization – Nations are investing heavily in advanced personal and vehicle protection systems to counter evolving threats.

• Lightweight Protection Needs – Composites now offer unmatched strength-to-weight ratios, reducing fatigue for soldiers and security personnel while maintaining protection levels.

• Technology Innovation – Advancements in fiber engineering, hybrid materials, and resin systems are enabling armor designs that were not technically feasible a decade ago.

This shift opens a path for manufacturers to deliver next-generation protective solutions across military, law enforcement, aerospace, and high-security civilian sectors.

High-Value Segments Driving Opportunities

1. Aramid Fiber-Based Solutions (47.6% Share in 2025)

Aramid fibers such as Kevlar® and Twaron® remain the preferred reinforcement for ballistic protection due to their superior mechanical strength, high thermal stability, and resistance to cuts, abrasions, and chemical degradation. Manufacturers that integrate multi-layer composite architectures and advanced processing techniques into aramid-based systems are well-positioned to dominate this segment.

2. Polymer Matrix Composites (52.1% Product Share)

Polymer matrix composites are the market’s most widely used product type, offering exceptional energy absorption, corrosion resistance, and design flexibility. They can be engineered for flexible or rigid armor systems and are adaptable to thermoplastic matrices for recyclability and improved impact tolerance—a critical factor for long-term sustainability in manufacturing.

3. Body Armor Applications (38.4% Share)

Body armor remains the single largest application, with rising demand from military, police, and private security forces. Manufacturers delivering lightweight, modular, and multi-threat armor kits will have a competitive advantage as buyers seek gear that meets multiple operational standards while reducing bulk.

Regional Growth Patterns – Where Manufacturers Should Focus

• China (CAGR 10.1%) – Rapid defense manufacturing expansion, strong domestic procurement, and increased exports of armor components. Key hubs in Jiangsu and Guangdong are scaling integration of thermoplastic composites into helmets and shields.

• India (CAGR 9.4%) – Government-backed indigenous armor programs and hybrid composite development for border security applications.

• Germany (CAGR 8.6%) – Innovation in vehicle armor and aerospace shielding, with advanced NATO-standard testing facilities.

• United Kingdom (CAGR 7.1%) – Growth in tactical protective gear, export-grade armor, and composite folding barriers for public security.

• United States (CAGR 6.4%) – Consistent demand across defense, homeland security, and vehicle armoring, with emphasis on multi-hit resistant ceramic-fiber hybrid systems.

Emerging Trends Manufacturers Can Capitalize On

Hybrid Fiber Systems: Combining aramid, UHMWPE, and glass fibers in layered structures creates a balance of flexibility, durability, and impact dispersion. Manufacturers offering customizable fiber content and orientation will meet evolving ergonomic and adaptability demands.

Expanding Vehicle Armor Segment: Vehicle armor already accounts for roughly 40% of market revenue and is growing. From military fleets to VIP transport, the requirement for modular, lightweight panels is opening new contracts for suppliers who can deliver retrofit kits and tailored panel systems.

Smart Armor Development: Integrating sensors or visual wear indicators into composite layers is a growing area, allowing operators to monitor armor integrity in real time—an innovation manufacturers can leverage for product differentiation.

Challenges – And How to Turn Them into Competitive Advantages

• Stringent Testing Protocols: Validation and certification processes are long and costly. Manufacturers who develop in-house testing capabilities and streamline quality assurance can reduce time to market.

• High Material and Production Costs: Raw materials like aramid fibers and advanced polymers remain expensive, while manufacturing requires precision layering and controlled environments. Investing in cost-efficient production technologies or exploring localized sourcing can unlock price-sensitive markets.

Competitive Landscape – Leaders and Innovators

The market is shaped by a mix of established leaders and specialized innovators. Companies like Honeywell International Inc. (Spectra®), Teijin Limited (Twaron®, Endumax®), BAE Systems plc, DuPont de Nemours Inc. (Kevlar®), and DSM Dyneema dominate global supply, offering proven materials across defense and security sectors.

Specialists such as MKU Limited, ArmorSource LLC, and Revision Military focus on helmet and body armor innovation, while Gurit Holding AG, Barrday Inc., and TPI Composites, Inc. bring advanced composites expertise for aerospace and transport protection.

In April 2025, BAE Systems awarded Integris Composites a contract to supply ballistic protection systems for CV90 Infantry Fighting Vehicles across multiple European nations, highlighting the scale of opportunities available to capable suppliers.

Request Ballistic Composites Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-22862

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Outlook – The Next Decade of Growth

From 2025 to 2035, the ballistic composites market is set to benefit from:

• Continuous military modernization and homeland security investments

• Demand for lighter, more adaptable protection systems

• Adoption of hybrid and smart armor technologies

• Expansion of vehicle armor and aerospace shielding applications

Manufacturers who align with these drivers—while addressing cost, testing, and production challenges—can secure a strong foothold in a market that is projected to more than double in size over the next ten years.

Related Insights from Future Market Insights (FMI)

Ballistic Protection Material Market - https://www.futuremarketinsights.com/reports/ballistic-protection-materials-market

Ballistic Floatation Vest Market - https://www.futuremarketinsights.com/reports/ballistic-floatation-vest-market

Geocomposites Market - https://www.futuremarketinsights.com/reports/geocomposites-market

Editor’s Note:

The Ballistic Composites Market is witnessing remarkable growth, driven by advancements in lightweight, high-strength protective materials. With applications expanding across defense, law enforcement, and security, manufacturers are innovating to meet evolving performance standards. This dynamic sector reflects the global push for enhanced safety without compromising mobility.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.